Hi everyone—I’m so glad to have you here. What a week.

Secretary of the Treasury Janet Yellen (75) was frog-marched onto national television following some Serious meetings between president Joe Biden (79) and Fed Chair Jerome Powell (69) to take the heat for a decade of poor decisioning that’s left an entire generation wondering how this bizarre retirement community of supposed wisdom could have messed up so consistently.

It’s clear that these elders are not bastions of wisdom and experience after all. In a sane and well-functioning society they would be thanked for their service and promptly relieved of duty.

Words are easy. Actions—mindsets—are not, and are the only things that end up mattering in the end. Yellen’s mea culpa is an encouraging first step, but she's not done with the 'I was wrong' process given her disastrous decision pattern over the past decade.

Most importantly, Yellen clearly doesn’t know why she got inflation wrong, and offers us no convincing assurance that she won’t be less wrong moving forward. Expect more wrongness, more apologies, and no admission of being at fault—just more “shocks,” “supply issues,” “Putin™,” “greedy corporations,” etc.

One problem is that Treasury Secretary is an appointed position, not an elected one, so We The People have no say in the matter. Ditto for J-Pow, who is Chair of a cartel of unelected bankers that aren’t even part of the US government at all.

Why is this retirement community mafia allowed to continually make mistakes time and time again without consequence and free from retribution from the people they’re inflicting harm upon?

That’s a rhetorical question of course. I don’t encourage you to ask it with actual sincerity unless you’d like to be swiftly disillusioned into a nihilist rabbit hole of cynicism lined with barbs of truth needles and corruption shards. It gets dark real quick.

We’ve come a long way since Alexander Hamilton became the nation’s first secretary of the treasury. For one thing, Hamilton was about 32 years old. The time horizon and incentives of those making decisions impact the nature of those decisions. Individual perspective unevenly blinds and illuminates, and no one is ever perfectly objective or rational. This is why checks, balances, and term limits are so crucial.

Just as a quick reminder, this was Janet just over 4 months ago. Remember this when you see Yellen headlines today. Nothing has changed. We are still very much on our own, and no one is coming to save you:

Making mistakes isn’t so bad, that’s how we learn. Repeating them, however, is. And where we are today is a result of the same delayed reaction and failure to understand as we saw leading up to and following the 2008 financial crisis. We’re just being looped inside a poorly written Netflix series where the only difference between seasons is the actors.

Again, this whole economic mess is a systemic, interconnected problem across the globe. This is part of why it’s foolish to think a few policy decisions and interest rate tweaks can fix things. Inflation in Germany just hit a 50 year high at the same time that the U.S. is experiencing record high inflation.

The kicker for America is that GDP growth is negative at the same time. This diabolical combo is known as stagflation, which we experienced back in the 70’s. This time, though, it’s very different and likely worse. Our debt was way lower back then, which means Fed Chair Paul Volcker could afford to raise rates high enough to be of any use. But Treasury yields right now are 3x lower than the inflation rate, so rates would have to be cranked so high to all but ensure a deep, painful depression full of terribleness.

Don’t put it past them:

I’ve written in the past about how history has shown that when a society reaches the end of a debt cycle like this and leaders find themselves wedged into this kind of corner, something Ray Dalio calls a “debt jubilee” occurs. This is when money is given away and debts are magically “forgiven” is an attempt to paper over the problem and cook the books into some semblance of respectability (while keeping the masses happy and not revolting entirely by giving them free stuff).

So when I see a headline like “Biden Administration’s Approval Of $5,800,000,000 In Automatic Student Loan Cancellation Is ‘Largest In History’” I think: Ah, more stimulus checks. The jubilee has begun.

Giving people money to spend is the same thing as removing money people owe. It’s all debits and credits. But this allows them to avoid the term “stimulus check.”

Is a society—an economy—healthy if it requires this level of unprecedented intervention, manipulation, and obfuscation? The president wants you to think so. You “have every reason” to “feel” confident about all of these shenanigans, and believe that the US has actually made “progress” and i in “a position of strength,” I’m told. 🤷♂️

Meanwhile, yet another major food factory caught fire under mysterious circumstances, at the plant in Minnesota that provides 3 million eggs to the largest retailers in the United States. Did you hear about this all over the news? I didn’t think so. Estimates say at least tens of thousands of chickens were killed.

Add it to the list. (For those just catching up, I addressed this string of mysterious food plant fires in Issue 73) Not great, but also not surprising that our attention is not being drawn to it.

And the hits keep coming in this record-setting year: The Case Shiller home price index saw the largest one month percentage gain in 35 years of data.

Eventually, we need to settle up the tab. The bill will come due, and it’s a doozy.

This is all part of the reason why the CEO of JP Morgan Chase urged everyone to brace themselves for an “economic hurricane” later this year.

It’s also helping to bring the era of USD as global reserve currency to a long, drawn out, messy close, as it was only ever previously propped up by artificial demand stemming from the petrodollar system. The tide, however, appears to be turning as the apparent inability for the US to repay debts and properly manage its economy is becoming a huge risk and liability for other nations. Oil is being sold for yen, rubles, and central banks are increasingly open to the idea of cryptocurrencies. Anything to drop the toxic greenback.

As expected, New York State—home of the incumbent old guard with the most to lose in this new paradigm (Wall Street)—continues to shoot itself in the foot in an attempt to stem the bleeding.

So while Texas is mining bitcoin from inside a city hall, and oil companies in Oman and across the Middle East are using excess gas for bitcoin mining and reducing emissions in the process, other regimes such as New York State are banning themselves from the network in what can only be described as… a mistake.

Another mea culpa. They’re all the rage these days. But the game theory continues as people vote with their feet, money, and brains.

Missing the impact, benefit, and elegance of the bitcoin network is no surprise given that it’s key value proposition has to do with the inability for people like Janet Yellen and Jerome Powell and Joe Biden in their infinite wisdoms to mess with the rules. It is the antithesis and antidote to our current monetary predicament.

Saifedean Ammous speaking on February 11, 2017 articulated nicely what the real value of Bitcoin is (the price at the time was ~$1,000):

“The real value of Bitcoin is not in its operation and it’s not in its payment network. It’s not in fast or cheap payments or any of that. The real value is in the immutable monetary policy.”

It’s also no surprise that this recently (and very great) report from Block underscores why certain things tend to make intuitive sense to those who need it, and escape the grasp of those whose vantage point comes from a place of comfort and monetary privilege.

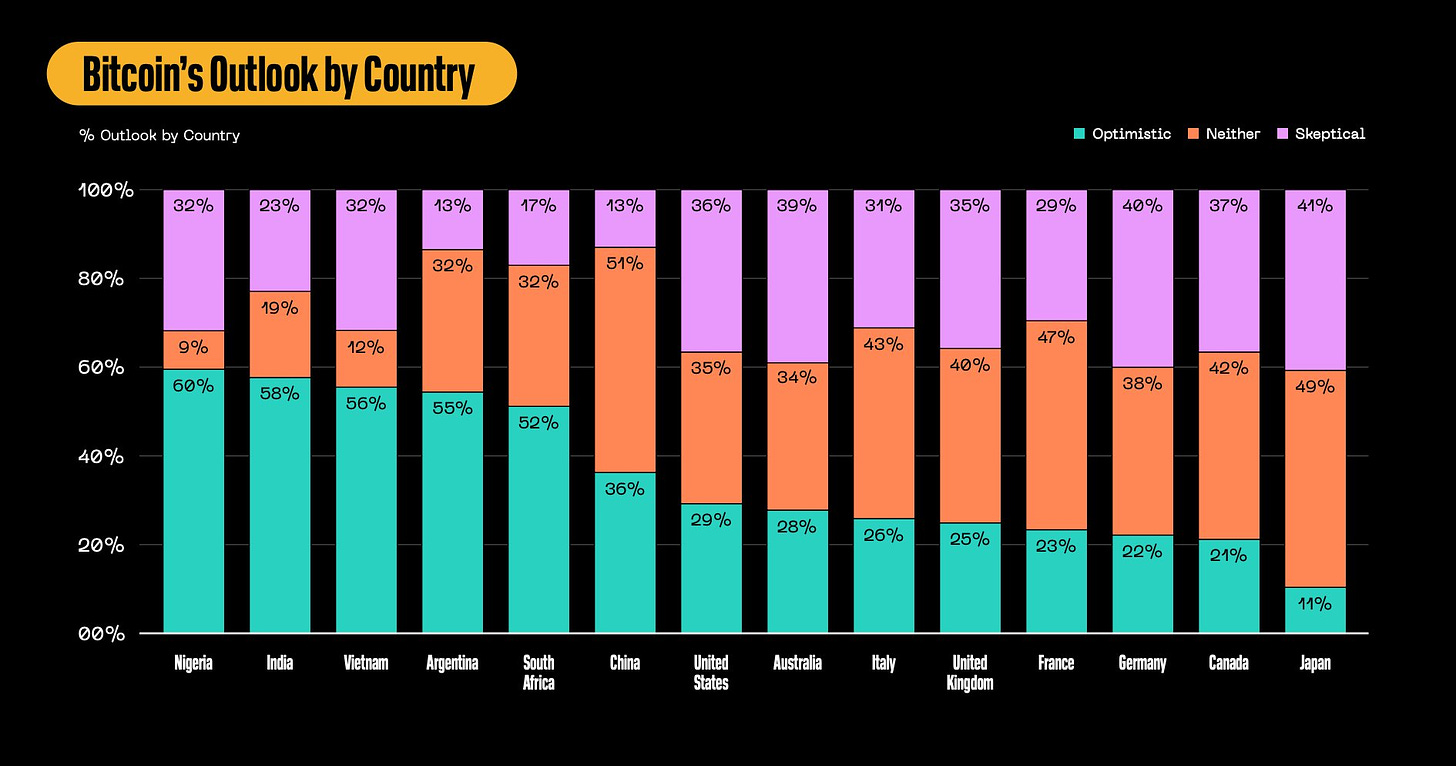

Who's most optimistic on Bitcoin? People from emerging market countries or authoritarian regimes. Who's least optimistic? People living under reserve currencies and liberal democracies.

No matter. Everyone gets bitcoin at the price they deserve. Yellen, Powell et. al. may or may not realize the err of their ways when it comes to monetary policy, but bitcoin doesn’t care.

That can be their culpa. It doesn’t need to be ours.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Surf Report: Mea culpa